Q3 Market Recap

It’s always great to start a message with the words, “The markets finished the quarter at an all-time high.” Fortunately, that’s the case this time around. The S&P 500 rose 2% in September, and 5.5% for the entire quarter. The Dow, meanwhile, gained 8.2% in Q3. Both indices set new records along the way.1

So, let’s do a quick recap of why the markets performed the way they did over the last three months. Then, we’ll tell you what we think might be the most interesting storyline from an investor’s perspective. We’ll finish with a few things to keep an eye on as we draw closer to the end of the year.

July

The quarter began with the markets already rebounding from a bout of volatility in early Q2. This was driven by good news regarding inflation, with consumer prices dropping to 3% in June.2 That led to renewed optimism that the Federal Reserve would finally cut interest rates sometime in the summer. But as July started making way for August, the skies over Wall Street began to turn cloudy. The optimism of a future rate cut shifted into concern that maybe, just maybe, the Fed had already waited too long.

August

This concern was primarily driven by rumblings in the labor market. Unemployment has been trending upward for some time now, and in July, the jobless rate rose to 4.3%.3 While that’s not a high number in a historical context, it was still higher than most economists expected. And it prompted investors to wonder whether future rate cuts would be enough to prevent unemployment from rising higher still, which could trigger a recession.

Just as investors were chewing over this unpleasant bit of data, the markets were hit by another interest rate whammy – this time, from overseas. While our rates have been at 40-year highs in recent times, Japan has kept their rates extremely low. Because of this, many investors were using a tactic called the yen carry trade. This involves borrowing Japanese currency at an absurdly cheap rate, then converting that cash into a stronger currency. With that stronger currency, investors could then buy U.S. securities, essentially at a discount. It’s been a popular tactic, but it unraveled in early August with the news that Japan was finally raisinginterest rates at the same time the U.S. was preparing to decrease theirs. That meant the yen was stronger in value than before. As a result, many investors were forced to quickly sell off the assets they bought before having to pay higher interest rates on the money they borrowed. This triggered a short but massive selloff across the entire globe.

All this was unpleasant, but thankfully, short-lived. By the end of August, the markets had completely regained what they had lost. Still, a sense of uneasiness remained, because September had arrived – historically, the worst month of the year for the markets.

September

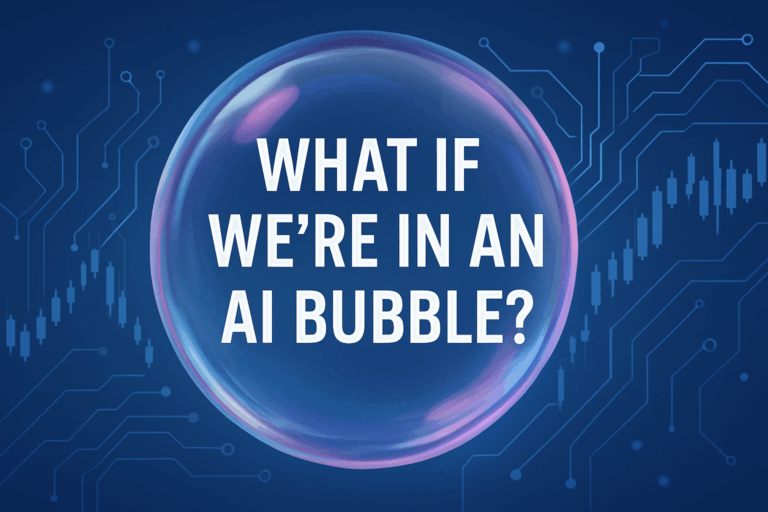

True to form, the markets began the month with another dip. Besides worrying about unemployment, investors were also mulling over the future of artificial intelligence. (More specifically, the companies that have invested heavily in it.) AI-related hype has been one of the biggest drivers of the current bull market, but far more money has been poured into AI than has flown out of it. Some analysts raised the question of whether the new technology is all it’s cracked up to be, and whether it will truly return enough value to shareholders to justify its costs.

But then came the news everyone had been waiting for. The August jobs report was modestly positive, indicating that unemployment was basically unchanged. (In other words, still higher than anyone would like, but not picking up momentum, either.) And the latest inflation report was even better: Inflation had fallen to 2.5%.4 The lowest mark since early 2021…and very close to the Fed’s goal of 2%. A rate cut was now all but certain. And on September 18, it finally happened. The first cut in over four years, to the tune of 0.50%.4 Based on this, the markets continued to climb, finishing the quarter at record highs.

So, an action-packed quarter, with plenty of twists and turns. But as much fun as it is to say, “record highs,” that may not even be the best news to come out of Q3.

Warren Buffett once said that interest rates act like gravity on valuation — meaning they pull stock prices down, or at least prevent them from rising too high. But despite higher rates, stocks have been in a bull market for the past two years. How can this be?

When we talk about “the stock market,” we tend to think of it as a single entity. But that’s far from the truth. As its name implies, the S&P 500 is made up of five hundred different companies, and the broader stock market contains thousands. At any given time, some of those companies are rising in value while others are falling. When more companies rise than fall, the markets do well, and vice versa. But sometimes, you don’t need a lotof companies to rise in value. You just need a handful to rise so much, they drag the overall value of the index along with it. That’s been the case for much of the past two years. Most of the market’s rise has been driven by a handful of tech giants, thanks to the AI boom we mentioned. But for the majority of companies on the stock market, growth has been much more modest. Interest rates act like gravity, remember?

One of the most interesting storylines is that this trend reversed last quarter. More than 60% of companies in the S&P 500 rose higher than the overall index in Q3.5 (For the previous quarters, it was only around 25%.) And the Russell 2000 index, which contains lots of smaller companies, rose by 9.3% for the quarter.5 All this suggests that the bull market is widening in breadth, which is a positive indicator for the future. (The broader a market incline, the longer that incline tends to last.)

Now, with all that said, there are still some question marks on the horizon that we need to keep an eye on. While geopolitics rarely has a sustained impact on the markets, conflict in the Middle East could inject turbulence into oil prices, which do affect the markets to a degree. Volatility can always spike in the weeks before and after a presidential election. And the biggest question mark is unemployment. Can the Fed actually achieve a soft landing, avoiding a recession as they continue cutting rates? These are the questions that only the future can answer.

For these reasons, it’s important we remain prudent with our investment decisions in the short-term…while always keeping our focus on the long-term. In the meantime, enjoy the upcoming holiday season! And as always, please let us know if you have any questions or concerns. Our door is always open.

SOURCES:

1 “S&P 500 ekes out record closing high,” Reuters, www.reuters.com/world/us/wall-st-eyes-lower-start-data-loaded-week-powells-comments-awaited-2024-09-30/

2 “Inflation falls 0.1% in June from prior month,” CNBC, www.cnbc.com/2024/07/11/cpi-inflation-report-june-2024.html

3 “Job growth totals 114,000 in July,” CNBC, www.cnbc.com/2024/08/02/job-growth-totals-114000-in-july-much-less-than-expected-as-unemployment-rate-rises-to-4point3percent.html

4 “Fed slashes interest rates by a half point,” CNBC, www.cnbc.com/2024/09/18/fed-cuts-rates-september-2024-.html

5 “Broadening gains in US stock market underscore optimism on economy,” Reuters, www.reuters.com/markets/us/broadening-gains-us-stock-market-underscore-optimism-economy-2024-09-30/