Every January, we here at Minich MacGregor Wealth Management look back on the year that was. What were the highlights? What were the “lowlights”? What events will we remember? Most importantly, what did we learn? Then, we send a Year in Review message to our clients that encapsulates it all. We thought you might be interested in seeing it this year, too.

When we ponder the last twelve months, the theme of 2024, to us, is the importance of being able to operate under uncertainty. Here’s what we mean.

When the year began, there were several question marks hanging over the economy, the markets, and the nation as a whole. Each question mark, on its own, was important. Putting them all together made it extremely difficult for investors to know how the year would play out, which way the markets would go, or how the economic climate would evolve. In other words, there was a great deal of uncertainty. Let’s go through a few of the most important question marks one by one.

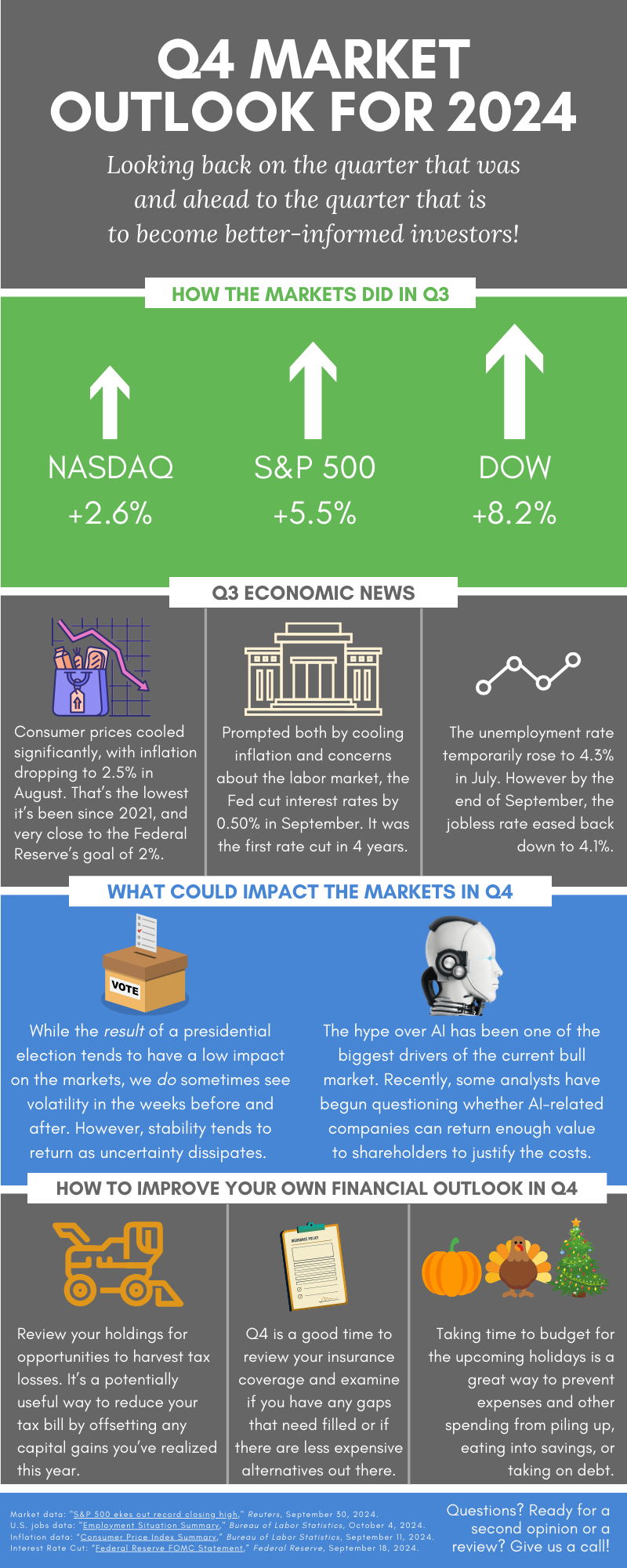

Which Way Will Inflation Go? The New Year kicked off with a positive outlook. Consumer prices had fallen significantly toward the end of 2023, and the expectation was that the trend would continue. But inflation rarely moves in a straight line. The inflation rate hovered around 3.1% in January, but by March, it was back to 3.5%.1 Inflation, it seemed, was still “sticky.”

This wasn’t pleasant news for the markets, because it dashed any hope that the Federal Reserve would cut interest rates in the spring. And the longer interest rates remained elevated, the more people worried about the possibility of a recession. As a result, the markets experienced a short-but-sharp dip in April.2

Fortunately, the angst was short-lived. Over the next six months, inflation fell to 2.4% — the lowest since February of 2021, and awfully close to the Fed’s goal of 2%.1 That led to a long-awaited event in September, when we finally got some clarity on the second question mark:

When Will Interest Rates Start to Come Down? Interest rates — the Fed’s primary tool for combatting inflation — began the year at 5.3%.3 That was the highest they’d been since early 2001. But while higher rates are effective at bringing prices down, the reason is because they cool down the economy. But if rates remain too high for too long, that coolant can ice over — and freeze the economy with it. Because of this, and because lower rates tend to juice the stock market, investors had been waiting with bated breath for any signs that rates were on the verge of coming down. Finally, in September, it happened: The Fed announced the first rate cut. Another one followed in October, and a third in November. By the end of the year, rates were down to 4.6%.3 That’s still historically elevated, but it’s a step in the right direction. That’s because we were also getting a positive answer to the third question mark:

Will the Economy Grow, or Slow? Predicting a recession has become something of a parlor game for economists. It’s not hard to understand why. Historically, raising rates to pull down inflation has almost always led to a recession. It’s called a hard landing, and it happens when prices come down so much that most businesses experience a major drop in revenue, causing them to lay off workers. Since unemployed people tend to spend less money, the economy contracts and enters a recession.

Despite years of dire predictions, this worst-case scenario never came true. Our gross domestic product, which measures our country’s total economic activity in a given period, grew by 1.6% in the first quarter, 3% in the second, and 3.1% in the third.4 As of this writing, we don’t have firm data for Q4 yet, but it’s estimated to be around the same.5

Against all odds, for now, it seems we’ve achieved something rare: A soft landing.

What About the Election? The fourth question mark was perhaps the least important as far as the markets were concerned, but it was also the one that got the most headlines: The November election.

Elections always create uncertainty, of course. Who will our next president be? What policies will they enact? How will they help or hurt my personal situation? History suggests that it doesn’t really matter which party controls Washington as far as the markets are concerned, but despite that, we do often see volatility leading up to the election itself. But that didn’t really happen this year. Other than a slight, brief dip at the very end of October, there was not a lot of volatility before the election, nor right after.6 Which brings us to our final question mark:

How Will the Markets React to All This? For investors, this was the biggest question mark of all. It’s always the biggest question mark of all. How would the markets react to the roller coaster of inflation? How would they react if it took longer for interest rates to drop? What about the election?

Well, now we know the answer to that, too. The S&P rose over 23% for 2024.7 When you couple that with the 24% gain we saw in 2023, it’s the best two-year performance in the index since 1997-98. The Dow, meanwhile, gained nearly 13%, and the NASDAQ over 28%.7

Because we are looking back, because we know the answers to all these questions, it’s hard to remember the uncertainty that crept up at different points in the year. Nevertheless, uncertainty existed — and the investors who could handle it, benefited. The ones who could not, did not. We’re very happy to say that our clients belonged to the first group, but we know many people who didn’t.

Throughout the year, especially early on, we would often hear acquaintances of ours say things like, “I’m not getting into the markets until after the election.” Or “I’ll wait until interest rates come down to make a decision.” “Inflation is still too high for me, so I’ll think about it next year,” also popped up from time to time. In other words, many investors find it difficult to operate under uncertainty. Any question mark causes them to defer decisions and delay actions. Uncertainty can cause people to shut down, circle the wagons, and “turtle up.” As a result, two things happen:

- They miss out on the kind of year we just experienced in the markets.

- They don’t move forward to their financial goals.

Uncertainty is a fact of life, and as investors, we will always be dealing with question marks. Some years, there are more question marks than others, and that can certainly make things stressful. Of course, when we’re faced with uncertainty, it’s always good to slow down, take our time, and consider our options carefully. But it’s not good to become stagnant, hesitant, or fearful. It’s never good to procrastinate.

Scientists have often held that one of the hallmarks of intelligence is the ability to make judgments under uncertainty. The ability to plan ahead even with limited information, and then adjust your plan as you learn. This is something that our team strives to do every day for our clients. We consider what we know and what we don’t. We try to identify possible outcomes and events, not to predict which will happen — which is impossible — but to prepare for as many as we can. From there, we determine what choices must be made now, which choices can be made now, and which should not be made now. Finally, we review the options that come with each choice, and which work best for each client based on their specific goals, needs, and situation.

It doesn’t mean everything will always go the way we want it to. It doesn’t mean we won’t occasionally experience setbacks. It does allow us to operate under uncertainty…which means we can always help our clients continue to work towards their dreams and financial goals.

That’s what financial planning is all about. And that, to us, is the lesson to take from 2024.

Of course, there will be question marks in 2025, too. Here are just a few:

- Is the inflation roller coaster truly over? Consumer prices ticked back to 2.6% in November, and there are some indications that they may rise higher still in the coming months.

- President-elect Trump has promised to levy across-the-board tariffs against China and many other countries. What effect will those tariffs have on the economy, especially inflation?

- Will interest rates continue to fall, or will they remain where they are for a while? In its most recent statement, the Fed projected only two cuts for 2025.8

- Much of the market’s performance over the last two years has been generated by tech companies, especially those investing in AI. However, to date, many AI companies are valued far above what they are actually earning. Will that change in 2025? Will the hype continue?

Here at Minich MacGregor Wealth Management, we’ll continue to study these issues…and even though you are not currently a client, we will update you as we get answers. But while there will always be question marks, we remain confident in our direction and in our ability to keep moving forward — whether the horizon is clear or blurry, the sky blue or gray.

So, that’s 2024! We hope it was a wonderful year. On behalf of our entire team, we look forward to making 2025 even better. As always, please let us know if you have any questions, or if we can ever help you and your family the way we help our client families. Have a Happy New Year!

Sources:

1 “12-month percentage change, Consumer Price Index,” U.S. Bureau of Labor Statistics, https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

2 “U.S. Equities April 2024,” S&P Dow Jones Indices, https://www.spglobal.com/spdji/en/documents/commentary/market-attributes-us-equities-202404.pdf

3 “Federal Funds Effective Rate,” Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/series/FEDFUNDS

4 “Gross Domestic Product,” U.S. Bureau of Economic Analysis, https://www.bea.gov/data/gdp/gross-domestic-product

5 “GDP Now,” Federal Reserve Banks of Atlanta, https://www.atlantafed.org/cqer/research/gdpnow/archives

6 “S&P 500 ends 5-month rally with October downturn,” S&P Global, https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/s-p-500-ends-5-month-rally-with-october-downturn-86066097

7 “S&P 500 posts 23% gain for 2024,” CNBC, https://www.cnbc.com/2024/12/30/stock-market-today-live-updates.html

8 “Fed cuts key interest rate but signals elevated inflation is likely to persist,” https://www.nbcnews.com/business/economy/federal-reserve-interest-rate-cut-december-2024-much-economy-rcna184586