Q3 Financial Checklist

In 2004, a NASA pilot named David Oberhettinger was flying himself and two passengers toward Palm Springs in California. Just as he was about to radio the nearest airport for permission to land, a “dense black smoke” began to fill his cockpit.1 It was immediately clear what was wrong: An electrical fire had broken out in his plane.

Nobody wants to panic at 8,000 feet above the ground. Luckily, Oberhettinger kept his head and immediately swapped his Descent for Landing checklist for the In-Flight Electrical Fire checklist. It listed five specific steps for averting disaster: (1) Master Switch to Off (2) Other Switches (Except Ignition) to Off (3) Close Vents/Cabin Air (4) Extinguish Fire (5) Ventilate Cabin.

As Oberhettinger later described it, completing the checklist “took maybe 90 seconds.” 1 The rest of the flight was a smooth, uneventful landing. For Oberhettinger, the crisis “hardly caused a significant increase in heart rate, because I just followed the checklist.” 1

There is a real power in checklists. They can prevent us from panicking, or from having to rely on our memory more than we have to. They prevent us from making the wrong decision at the worst time. And while the checklists we create as financial advisors don’t usually involve the life-or-death drama of a pilot checklist, they are vital all the same.

With that in mind, we’ve created a new checklist specifically for the third quarter of the year. This checklist has six steps. Don’t worry, they’re not difficult! You may have handled some already. Others may not even apply to you. But each task is important in its own way. Put them all together and you will be more likely to enjoy a smooth and uneventful flight towards your financial goals. And while you won’t be able to complete the checklist in 90 seconds, 90 days should be more than ample. As always, if you need help or have questions about any of these, please let me know. In the meantime, we hope you have a great third quarter…and a wonderful summer!

Q3 Financial Checklist for 2024

Tip: Print this out and stick it on the fridge or somewhere else it will be seen. That way, you can check off the items one by one as you complete them!

- Reprioritize Your Goals

With the year now half over – where did the time go? – you may find that you have already accomplished some of the goals you set for yourself this year. Others may be behind schedule; some may still just be words on paper. That’s okay! Working towards our goals should always be a marathon, not a sprint. That makes this a good time to reprioritize your goals. Do you have new goals that you didn’t have in January? If so, write them down. Are there older objectives that need to be given more attention? If so, determine where they need to be placed on your schedule. By doing these things, you can ensure that the back half of 2024 is as productive and fruitful as possible.

- Fund Your Child/Grandchild’s Education

It’s summer vacation now, but Back-to-School season will be here before you know it. If you have any children or grandchildren whom you want to ensure receive a higher education, use Q3 to either set up a new education funding account or contribute to one you already have. From 529 Plans to Coverdell Education Savings Accounts, you have many options to choose from. The key is choosing the right one for you, and then contributing to it consistently. Please let us know if you need any guidance on this – we’d be happy to help!

- Check Your Credit Reports

Credit reports aren’t just for getting loans – they’re a handy early-warning system for fraud and identity theft. A good rule of thumb is to check your credit reports at least once per year. If you haven’t checked yours yet in 2024, now is the best time to do so. Be on the lookout for recent changes that don’t look familiar to you as well as “hard inquiries.” This is when a business checks your credit report because they received a new application for credit or services. These can impact your score and stay on your reports for two years or so. They can also show you when people are trying to use your information illicitly.

- Review Your Beneficiaries

If you’ve had any major life changes – or if anyone in your family has – it’s a good idea to conduct a “beneficiary audit.” Is everything still accurate and up to date? If not, adjust your will and estate plan now so that your loved ones will always be taken care of, and your legacy ensured.

- Pay Off Any Debts Incurred Earlier This Year

It’s not uncommon to rack up debts during the first half of the year. From vacations to home renovations to new purchases, it’s easier than ever to reach for the nearest credit card. There’s nothing wrong with that – so long as those debts don’t linger and grow. Pay them off now, if possible — or at least make a dent — so they don’t weigh you down as you work toward your long-term goals.

- Evaluate Your Auto-Pay Bills

Finally, if you’ve placed bills on autopay, be sure that the card or bank account the various companies have on file is correct. Review whether certain bills have gone up, and whether there are less expensive options to consider. And be sure to cancel any subscriptions you no longer need!

“Why do I love checklists? Because in 2004 a checklist helped avert what could have been some serious unpleasantness. And because rather than letting my imagination run amok to my detriment (otherwise known as “panicking”), effective use of checklists allow me to direct my imagination to more productive purposes.”

— David Oberhettinger, former NASA Pilot and Chief Knowledge

Officer Emeritus at the Jet Propulsion Laboratory1

1 David Oberhettinger, “Why I Love Checklists,” NASA, appel.nasa.gov/2015/08/26/my-best-mistake-david-oberhettingers-why-i-love-checklists/

Election Misconceptions

The noise can be deafening. It seems to come from everywhere, all the time. It can cause headaches, frustration, even anxiety. Sometimes, you wish you could turn it off altogether.

No, we’re not referring to whatever music the kids are listening to these days. We’re referring to the noise surrounding the upcoming presidential elections.

Election season is one of the most important aspects of our political system, but there’s no doubt that getting through it can be stressful. All of us, at some point, will wonder things like, “What if my preferred candidate doesn’t win?” “Who is my preferred candidate, anyway?” “Does so-and-so really mean this?” “Did so-and-so really say that?” “What’s fact and what’s fiction?”

One thing you shouldn’t have to worry about is how the elections will affect the markets. Every four years, many misconceptions arise about the impact of presidential contests on your portfolio. These often lead to unnecessary anxiety for investors. As financial advisors, our goal is to ensure our clients feel confident about their financial future, not worried. That’s why we send educational messages like this one. Let’s explore three common misconceptions about election season and the markets.

The first misconception is that presidential elections lead to down years in the markets. It’s understandable why we might feel this way. When we look back at past elections, the first things we remember are probably the controversies, uncertainties, and negativity. Election years feel volatile in our minds and memories, usually because there’s so much drama and so much at stake.

But statistics prove this misconception is a myth. Since 1944, there have been twenty presidential elections. In sixteen of those, the S&P 500 experienced a positive return for the year.1 In fact, the median return for presidential election years is 10.7%.1 Of the four election years that saw a negativereturn, two did occurin this century – in 2000 and 2008 – but on both occasions, the nation was either entering or in the midst of a significant recession.

Now, we do sometimes see increased volatility in the months leading up to an election. If we just look at how the S&P 500 performed from January through October in a presidential election year, the median return drops to 5.6%.1 That’s not bad, but it is nearly 50% lower. This suggests the uncertainty over who will triumph in the election – and the debate over what each candidate’s policies will mean for the economy – does tend to have at least some effect. Then, as the victor is announced and the picture becomes a little clearer, volatility tends to subside, and investors move on to other things. So, in that sense, election season does matter, but nowhere near what the media may have you believe. Elections are just one of the many ingredients in the gigantic stew that is the stock market…and they’re far from the most important.

The second misconception is that if one candidate wins, the markets will plummet. This narrative is, frankly, driven by pure partisanship. The fact of the matter is that the markets have soared under both Republican and Democratic presidents. Naturally, they’ve occasionally soured under both parties, too. Since 1944, the median return for the S&P 500 in the year after a presidential election is 9.8%.1 Since 1984? The median return rises to over 24%.

The reason for this is because of that gigantic stew we mentioned. You see, the markets are driven by the economy more than by elections. By the ebb and flow of trade, the law of supply and demand, by innovation and invention, by international conflict and consumer confidence. And while the president does have an influence on all this, it’s just one of many, many influences. As a result, the markets are far more likely to be affected by inflation and whether the Federal Reserve will cut interest rates than by the election.

When you think about it, the markets are like life. The course our lives take isn’t determined by one gigantic decision, but by the millions of small decisions we make every day. The same is true for the markets. We don’t know about you, but we find this comforting.

The third misconception is that we have no control over any of this, and thus, no control over what happens to our portfolio.

It’s true. We can’t dictate who the president will be. We can’t determine how the markets will react. But what we can control is what we will do. And that, is a mighty power indeed.

There’s a reason we began this email by referencing noise. As investors, one of the keys to long-term success is filtering out the noise and focusing on what reallymatters. You see, the goal of all political campaigns – and the media that covers them – is to create noise. That’s because noise provokes emotions. Fear. Anxiety. Anger. A greater emotional response leads to more clicks, more views, more shares, more engagement…and, yes, more money. It’s understandable why campaigns and the media want these things. But what we must guard against is letting those emotions drive our financial decisions. Emotions promote the urge to do something – buy, sell, get in, get out, take on more risk, less risk, you name it. They prompt us to make short-term decisions to alleviate what is, when you think about it, a short-term concern.

A presidential term lasts four years. But the goals you have saved for, and the time horizon you have planned for, lasts much longer than that. That’s why our investment strategy is built around the long-term. It’s designed to help you not just tomorrow, or next month, but years and years from now. It’s designed so that the president of the United States, as important as he or she may be, is only a passing mile-marker on the much longer road to your goals and dreams.

As we approach another election, keep this in mind: tune out the noise. Be aware of these misconceptions and avoid them. Our team is here to answer your questions and provide any assistance you need. If you’d like help planning for your financial future, give us a call. We’re always here to help.

Have a great summer!

1 “Election year market patterns,” ETRADE, us.etrade.com/knowledge/library/perspectives/daily-insights/election-stock-patterns

5 Financial Regrets

This is about common financial regrets. It lists five specific regrets that many people have, three of which were found to be especially common in a recent Forbes study. The infographic also covers how to avoid these regrets, and we you can help.

Questions You Were Afraid to Ask #13

The only bad question is the one left unasked. That’s the premise behind many of our recent posts. Each covers a different investment-related question that many people have but are afraid to ask. In our last post, we discussed what it means to invest in commodities and how regular investors do so. So, without further ado, let’s break down:

Questions You Were Afraid to Ask #13:

What are the pros and cons of investing in commodities?

As we covered in Question #12, a commodity is a physical product that is either consumed or used to produce something else. For example, corn, sugar, and cotton are all agricultural commodities. Pork, poultry, and cattle are livestock commodities. Oil, gas, and precious metals like gold and silver are commodities, too.

A commodity is generally seen as an alternative investment. Traditionally, large institutions and professional traders are the most likely to invest in commodities, but regular people can, too. Like every type of investment, though, there are both potential benefits and risks that come with commodities. Some of these are very specific to commodities.

First, let’s look at some of the pros of investing in commodities:

Diversification. As you know, all types of investments will rise and fall in value at different times. That’s why it’s important that your portfolio consists of diverse asset classes, each driven by different factors. (Financial advisors like us refer to this as having low correlation, meaning price changes in one asset don’t affect the price of another asset.)

Typically, commodities have a low correlation to stocks and bonds. Every type of commodity is affected by different economic factors. Most of those don’t usually affect, say, stocks. For example, while changing interest rates can have a major impact on stocks, they don’t have a direct effect on cotton prices. And though a hurricane in the Gulf of Mexico can dramatically impact oil prices, it usually doesn’t mean much to the overall stock market.

For these reasons, investing in commodities can add valuable diversification to your portfolio.

Diversification is important because it can help cushion your portfolio from major volatility. If one asset class takes a hit, the others could help compensate. However, it is important to note that diversification doesn’t eliminate risk.

Hedge Against Inflation. During periods of high inflation, the price of most consumer goods and services will go up. While that can make for an unpleasant-looking receipt at the grocery store, it can be a boon to commodity investors. That’s because the price of many commodities tends to go up with inflation. As a result, investing in commodities can help “hedge” – or lessen – the risk of investing in other asset classes that may be negatively affected by inflation.

Potential for Significant Returns. Commodities can also – potentially – produce meaningful returns. Certain types of commodities will occasionally rise drastically in demand, taking their price up with them. As a result, investing in the right commodity at the right time can certainly help investors generate a significant profit!

Of course, that same potential is also behind some of the downsides to investing in commodities:

Volatility. Commodities can be extremely volatile. As you’ve no doubt seen, the price of any commodity (say, oil, or gold) can fall remarkably fast if the demand for those products falls far below their supply. For these reasons, you should only invest in commodities if you can afford to take on the…

Multiple Risks. As we mentioned, all types of investments come with risks. However, the risks associated with commodities are particularly large and varied. For example, some commodities – especially agricultural ones – are vulnerable to weather. Others can be affected by natural disasters, military conflicts, or changing government regulations. While these same factors can certainly drive prices up, they are also just as likely to drag prices down if the wrong conditions arise. Furthermore, investors have no control over these types of risks…and they are notoriously difficult to predict in advance.

No Income. Finally, commodities do not produce any income for investors the way bonds or dividend-paying stocks do. So, investors seekingincome – especially retirees – may find that the pros of commodities are just not worth the risks when it comes to fulfilling their needs.

In the end, there’s simply no “one size fits all” type of investment, and that’s especially true of commodities. While they can be a viable fit for some portfolios, every investor must look carefully at whether commodities are right for their needs, and whether the risks associated with them are more than they can afford.

So, now you know the “how” and the “why” of investing in commodities. In our next few posts, we’re going to demystify common investment–related jargon you may hear bandied about by the media. In the meantime, have a great month!

Questions You Were Afraid to Ask #12

The only bad question is the one left unasked. That’s the premise behind many of our recent posts. Each covers a different investment-related question that many people have but are afraid to ask. In this post, let’s cover a specific type of investment that people often wonder about:

Questions You Were Afraid to Ask #12:

What does it mean to invest in commodities?

In an investing context, a commodity is a physical product that is either consumed or used to produce something else. For example, corn, sugar, and cotton are all commodities. We generally refer to products like these as agricultural commodities. Pork, poultry, and cattle are livestock commodities. Energy products, like oil and gas, are commodities, too. So are precious metals like gold, silver, and platinum.

A commodity is generally seen as an alternative investment. Alternative investments are called that because they trade less conventionally than more traditional stocks and bonds. Despite this, many people find the idea of investing in commodities to be an attractive one. For some, it’s because it makes more intuitive sense than owning shares in a company (buying stock) or lending money to an organization (buying bonds). There’s something tangible about the idea of investing in things we see and use daily. By comparison, stocks and bonds can feel a little more abstract. For others, investing in commodities is a way of adding even more diversification to a portfolio.

That said, the question of how to invest in commodities can be an overwhelming one. Most people – including experienced investors – don’t even know how to get started! So, let’s discuss some of the potential ways to invest in commodities. Then, in our next post, we’ll cover some of the pros and cons of this particular asset class.

The oldest and most basic way to invest in commodities is to physically own them. This is what traders have been doing for most of human history. Person A buys a herd of cattle from Person B, and then sells some or all of them to Person C, hopefully for a profit. Person X buys a stack of gold bars from Person Y and then sells them to Person Z. You get the idea.

This, of course, is still done today. But for most retail investors – regular folks like you and me – taking physical ownership just isn’t feasible. When you buy commodities, you must also have a way to store them. Unlike stocks and bonds, commodities take up space… usually a lot of it! You must also have a way to deliver the commodities to and fro. You’d also want to purchase insurance on the product in case something went wrong. And of course, you would need to have a lot of technical expertise to know how to trade those commodities for a fair price.

For these reasons, most investors choose one of two avenues: Buying stock in companies that produce commodities or by investing in commodity-based funds. Let’s start with the first.

Let’s say you wanted to invest in a certain type of precious metal that you feel will rise in value in the future. Obviously, for reasons we’ve already covered, you don’t want to own the metal itself. So, instead, you buy stock in a company that specializes in mining or extracting that particular metal. Should the price of that metal go up, it’s quite possible that the stock price for the company that specializes in that metal will go up, too.

Another way to invest in commodities is through commodity-based funds. You may remember our previous post on the different types of investment funds. Commodity-based funds are very similar, except they are centered around specific commodities. The fund may be comprised of a number of companies that specialize in the commodity. Some funds may even purchase and store the physical product itself if they have the means to do so. Either way, these types of funds – which can be mutual funds or exchange-traded funds – can give you exposure to whatever commodities you’d like to invest in.

There is another way that some investors participate in commodities called future contracts. These are “contracts in which the purchaser agrees to buy or sell a specific quantity of a physical commodity at a specified price on a particular date in the future.”1 So, let’s say an investor purchases a contract to buy X barrels of oil for $75 per barrel at some later date. By doing so, they anticipate the price of oil will rise above that, so their price affectively becomes a bargain. Then, when the specified date arrives, the investor accepts a cash settlement. This means the investor is credited with the difference between the initial price they paid and the current market price. This is instead of receiving physical ownership of the oil. Of course, if the price of oil goes below $75 per barrel, the investor would have to pay back that difference themselves.

Commodity futures are a complex topic, and to be honest, individual investors rarely turn to them. They are more often used by institutional investors like commodity-based funds.

So, that’s the how of investing in commodities! In our next post, we’ll get more into the why by discussing the pros and cons of commodities. As you know, all types of investments come with risks, and commodities are no exception. They’re certainly not right for everyone!

In the meantime, now you know what it means to “invest in commodities.” We look forward to diving even deeper into this topic in our next post.

1“Futures and Commodities,” FINRA, https://www.finra.org/investors/investing/investment-products/futures-and-commodities

2023: The Year in Review

Every January, it’s customary to look back on the year that was. What were the highlights? What were the “lowlights”? What events will we remember? Most importantly, what did we learn?

As you know, many noteworthy and historic events happened in 2023. Conflicts in Gaza, Ukraine, and Sudan. India surpassed China as the most populous country in the world. New temperature records were set all around the globe. The use of “artificial intelligence” exploded and turned multiple industries on their heads. Chinese spy balloons and deep-sea submarines grabbed the headlines. The “Barbenheimer” phenomenon reinvigorated Hollywood.

But in some ways, one of the most notable occurrences of 2023 is what didn’t happen: We never entered a recession.

When 2023 began, the fear of a recession was so widespread that it almost seemed inevitable. According to one survey, 70% of economists expected a recession to hit the U.S. in 2023.1 Another survey found 58% of economists believed there was a more than 50% chance of a recession. 1 For politicians, pundits, and analysts, it was practically all they could talk about.

But it never happened. Instead, the economy grew by 2.2% in the first quarter, 2.1% in the second, and 4.9% in the third.2 (As of this writing, the numbers for Q4 are not yet available, but it’s expected to go up again.) None of this is to say that our economy is perfect, or that we won’t have a recession in the future. But for 2023, all the gloomy forecasts simply didn’t come to pass.

Now, let’s be fair to all those economists who got it wrong: They had very good reasons for expecting a recession. Reasons based on data, logic, and history.

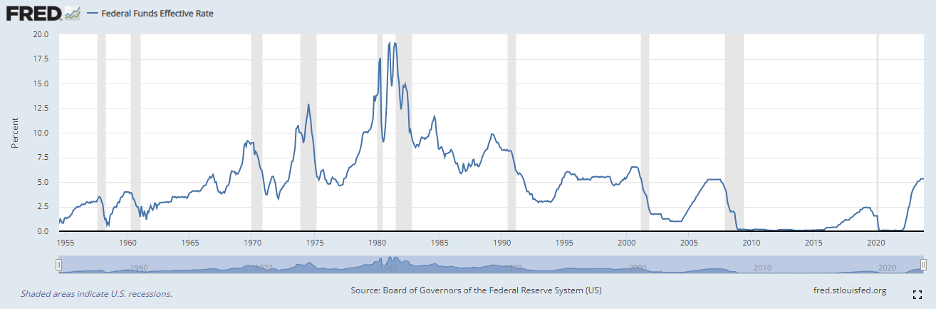

You see, when the year began, the U.S. was coming off a nasty 2022. While consumer prices were already coming down from their earlier highs, the national inflation rate was still 6.5%.3 Interest rates, meanwhile, had risen dramatically, from just above 0% at the beginning of 2022 to over 4% by the end.4 It was already the highest level we’d seen in fifteen years – just before the Great Recession, in fact – and every indication was that rates would continue to rise higher. All this economic pain was reflected in the stock market. The S&P 500, for example, dropped over 19% in 2022.5

For economists, all this data seemed to point a clear way forward. The Federal Reserve is mandated to keep consumer prices as stable as possible. (Its target has long been to hold inflation to around 2%.) When inflation runs hot, the Fed’s main tool for lowering it is to raise interest rates. Higher rates often lead to lower consumer spending. Lower spending, in turn, prompts businesses to decrease the cost of the goods and services they provide. Essentially, higher rates create an environment where supply is greater than demand, thus cooling inflation.

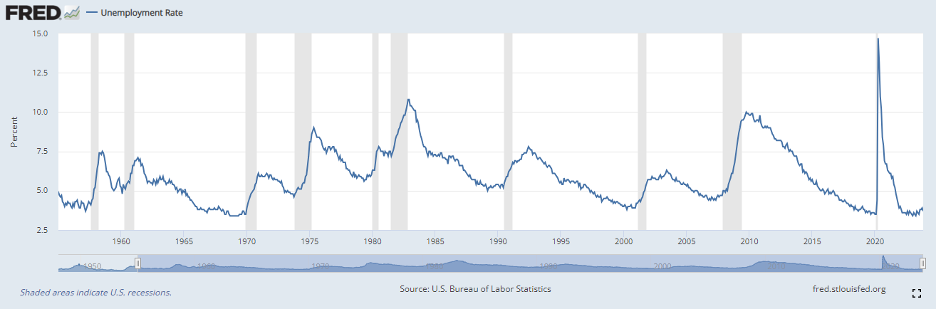

But there’s a side effect to this. If spending drops too much, businesses are often forced to cut back on expansion, investment, and labor costs. This leads to a rise in unemployment…and a contracting economy. In short, a recession.

This string of events isn’t just logical. It’s supported by history. When inflation has skyrocketed in the past, the Fed’s playbook has usually worked to bring prices down…but it’s usually triggered a recession, too. Economists call this a “hard landing.”

Look at these two charts. The top shows interest rate levels since 1955.3 The gray bars indicate a recession. Notice how often a gray bar appears in the aftermath of a sharp rise in rates? Similarly, the bottom chart shows the unemployment rate.6 See how the gray bars always coincide with a major spike in unemployment? It’s clear that, historically, fast-rising rates often trigger a rise in unemployment…which contributes to a recession.

What about when prices come down, but the economy does not? Economists call that a soft landing, and it’s proven to be very difficult to achieve. It’s no surprise, then, that most economists predicted a hard landing in 2023.

One year later, that hasn’t happened. Interest rates did continue to rise. As of this writing, they’re at 5.3%.4 Inflation has continued to cool, albeit slowly. As of November, the inflation rate was 3.1%. That’s a 3.4% drop from the beginning of the year.3 But consumer spending has remained steady. The labor market has remained strong. The unemployment rate was only 3.7% as of November.6 And, as we’ve already covered, the economy has continued to grow.

From a financial standpoint, this, to us, is the major storyline of 2023. Which means we must ask ourselves: “What can we learn from it?” As financial advisors, we’ve taken the time to jot down a few lessons we think are worth remembering as we move into the New Year. Here they are:

#1: Always emphasize preparation over prediction. The economists who predicted a recession weren’t stupid. They used the best data they had to make the best predictions they could. But 2023 shows that even the most well-informed people simply can’t see the future. Even the near future! There are simply too many variables to consider. That’s why, as investors, we must always emphasize planning over predicting. We can’t predict when the markets will drop nearly 20%, as they did in 2022.5 Or, when they’ll rise by well over 20%, as they did in 2023.5 What we do at Minich MacGregor Wealth Management is plan ahead for what each of our clients should do if the markets fall, or if they rise. We help our clients prepare mentally and financially for both market storms and market sunshine. So that they can weather the former and take advantage of the latter.

When investors predict, they’re essentially swinging for the fences on every pitch. Occasionally, a prediction can lead to a home run…but it can also lead to a lot of strike outs. By planning, we don’t have to swing at all. Since we can’t control the situation, we simply make the best out of every situation. We control only what we can control – ourselves.

#2: Be wary of confirmation bias. Earlier in the year, we spoke to many people who were convinced a recession would happen. Because of that, they tended to disregard all data that pointed away from a recession, and only valued information that confirmed what they already believed. As a result, many investors missed out on a stellar market recovery. Thankfully, our clients did not. This is another example of why preparing is much better than predicting. It removes emotion from decision-making. At Minich MacGregor Wealth Management, we’re not so focused on “being right” as we are on “being ready.”

#3: Remember that past performance is no guarantee of future results. You’ve probably seen this line in the past, and 2023 is a great example of why. Just because rising interest rates have led to recessions in the past doesn’t mean they always will. Just because the markets went one direction yesterday doesn’t mean they’ll go the same direction tomorrow. While history isa great resource to draw from when making decisions, it’s just a guide, not a guarantee.

#4: At the same time, don’t anchor to the present. As humans, we have a natural tendency to think that the way things are today is how they’ll be tomorrow. When 2022 ended, many investors felt that 2023 would be much the same. Now, investors run the risk of thinking that just because a recession didn’t happen last year, it won’t happen this year.

Again, it all goes back to planning and preparation. Here at Minich MacGregor Wealth Management, we will continue to prepare for all possible outcomes. We’ll help our clients plan for how to reach the outcomes they want and avoid the ones they don’t. We would love to help you, too! But instead of predicting, instead of assuming, instead of anchoring, we will accept that the future is written in clay, not stone. Only when it becomes the past does it harden. By doing this, we can help shape your future into whatever it is you want it to be.

So, that’s 2023! We hope it was a wonderful year. If you ever need any help making 2024 even better, know that we are always here. In the meantime, we wish you a Happy New Year!

SOURCES:

1 “Top US economists are often wrong – should we trust their predictions?” The Guardian, www.theguardian.com/business/2023/nov/19/us-economists-wrong-predictions

2 “Annualized growth of real GDP in the United States,” Statista, www.statista.com/statistics/188185/percent-change-from-preceding-period-in-real-gdp-in-the-us/

3 “United States Inflation Rate,” Trading Economics, https://tradingeconomics.com/united-states/inflation-cpi

4 “Federal Funds Effective Rate,” St. Louis Fed, https://fred.stlouisfed.org/series/FEDFUNDS

5 “S&P 500 Historical Annual Returns,” Macrotrends, https://www.macrotrends.net/2526/sp-500-historical-annual-returns

6 “Unemployment Rate,” St. Louis Fed, https://fred.stlouisfed.org/series/UNRATE

Our Newest CERTIFIED FINANCIAL PLANNER™

John Wooden, the legendary coach from UCLA, once said, “Success comes from knowing you did your best to become the best you are capable of becoming.”

Why are we sharing this quote with you right now? Because a valued member of our team at Minich MacGregor Wealth Management just took a huge step toward becoming the best.

Andrew Pallas just became a CERTIFIED FINANCIAL PLANNER™!

Now, there are many different credentials and designations in financial services. But earning your CFP®, as it’s known, is a big deal. In our opinion, the CFP® is one of the highest and most important certifications a financial advisor can earn. It is a mark that the holder has the education and expertise to help people from all walks of life be able to effectively manage their money, plan for retirement, and work toward their financial goals.

Of course, Andrew always had the talent for doing these things. Now, he also has the training.

We are so proud of what Andrew has accomplished because we know how much work it took. To become a CERTIFIED FINANCIAL PLANNER™, he had to complete demanding courses in various aspects of finance, including investing, tax planning, retirement planning, estate planning, risk management, government regulations, and more. Then, Andrew worked to pass a grueling, six-hour long test to prove what he learned. (A test that, on average, only 65% of people pass.1) Of course, this was all on top of the thousands of hours of professional experience Andrew had to acquire first. The result is an even greater ability to serve you and our other clients!

Andrew has consistently impressed us with his desire to help clients, learn new skills, and be the best financial professional possible. We’re so lucky to have him on our team. So, please join us in congratulating Andrew on this accomplishment. And as always, please let all of us here at Minich MacGregor Wealth Management know if there is ever anything we can do for you!

1 “Historical Stats,” CFP Board, https://www.cfp.net/-/media/files/cfp-board/cfp-certification/exam/historical-stats.pdf

Questions You Were Afraid to Ask #10

The only bad question is the one left unasked. That’s the premise behind many of our recent posts. Each covers a different investment-related question that many people have but are afraid to ask. So far, we’ve discussed the essentials of how the markets work, the differences between various types of investment funds, and the ins and outs of stocks and bonds.

A few months ago, however, an acquaintance of ours asked us a question not about investments but investing. Specifically, she wanted to know our thoughts on the modern trend of using mobile investing platforms — aka “investing apps.”

It’s a terrific question, because the use of such apps — and the number of apps available — has exploded in the past few years. So, in this message, we’d like to continue our series by answering:

Questions You Were Afraid to Ask #10:

What are the pros and cons of investing apps?

Mobile investing apps enable people to buy and sell certain types of securities right from their phone. They have provided investors with a quick and easy way to access the markets. For new investors who are just getting started, these apps have made the act of investing more accessible than ever before.

That’s a good thing! Even today, many people only invest through an employer-sponsored retirement account, like a 401(k). That’s because they may lack the resources, confidence, or ability to invest in any other way. But not everyone has access to a 401(k). And while 401(k)s are a great way to save for retirement, many people have other financial goals they want to invest for, too. Mobile apps provide a handy, ready-made way to do just that.

Continuing with the accessibility theme, many apps enable you to invest right from your phone, anytime, anywhere. In addition, many apps don’t require a minimum deposit, so you can start investing with just a few dollars. Finally, the most popular apps often charge extremely low fees – or even no fees at all – to buy or sell stocks and ETFs.

Many apps also come with features beyond just trading. Some apps will help you invest any spare change or extra money, rather than let it simply lie around in a bank account. Others enable you to invest automatically – daily, weekly, bi-weekly, monthly, etc. That’s neat because investing regularly is a key part of building a nest egg.

It’s no surprise, then, that these apps have skyrocketed in popularity. In fact, app usage increased from 28.9 million in 2016 to more than 137 million in 2021.1 Part of this surge was undoubtedly due to the pandemic. With social distancing, many used the time to try new activities and learn new skills from the safety of their own home…investing included.

But before you whip out your phone and start trading, there are some important things to know, first. Investment apps come with definite advantages…but also some unquestionable downsides. When you think about it, an app is essentially a tool. Like any tool, there are things it does well…and things it can’t do at all. And, like any tool, it can even be dangerous if misused.

The first issue: the very accessibility that makes these apps so popular is also what makes them so risky. When you have a tool that provides easy, no-cost trading, it can be extremely tempting to overuse it. Researchers have found that this temptation can lead to overly risky and emotional decision-making, as investors try to chase the latest hot stock or constantly guess what tomorrow will bring.2 The result: Pennies saved on fees; fortunes potentially lost on speculation.

The second and biggest issue is that while these apps make it easy to invest, they provide no help with reaching your financial goals. No app, no matter how sophisticated, can answer your questions. Especially when you don’t even know the questions to ask. No app can hold your hand and help you judge between emotion-driving headlines and events that necessitate changes to a portfolio. No app can help you determine which investments are right for your situation. Just as you can’t hammer nails with a saw, or tighten a bolt with a screwdriver, no app can help you plan for where you want to go and what you need to get there.

Take a moment to think about the goals you have in your life. They could be anything. For instance, here are a few our clients have expressed to me over the years: Start a new business. Visit the country of their ancestors. Support local charities and causes. Design and build their own house. Play as much golf as possible. Volunteer. Visit every MLB stadium. Send their kids to college. Read more books on the beach. Tour national parks in a motorhome. Spend time with family.

Achieving these goals often requires investing. But there is more to investing than just buying and selling stocks. More to investing than simply trading. Investing, when you get down to it, is the process of determining what you want, what kind of return you need to get it, and where to place your money for the long term to maximize your chance of earning that return. It’s a process. A process that should start now, and last for the rest of your life. A process that an app alone cannot handle – just as you can’t build a house with only a saw.

So, our thoughts on mobile investing apps? They are a tool, and for some people, a very useful one. But they should never be the only one in your toolbox.

In our next post, we’ll look at two other modern investing trends.

1 “Investing App Usage Statistics,” Business of Apps, January 9, 2023. https://www.businessofapps.com/data/stock-trading-app-market/

2 “Gamified apps push traders to make riskier investments,” The Star, January 18, 2022. https://www.thestar.com/business/2022/01/18/gamified-apps-push-diy-traders-to-make-riskier-investments-study.html

What makes Veterans Day so important?

When Dr. Harold Brown was young, he dreamed of flying. So, he worked hard as a “soda jerk,” making ice cream sodas at the local drugstore every afternoon to save up enough money for flight school. Eventually, he amassed a grand total of $35…enough for seven lessons.

It was the early 1940s.

While Harold didn’t know it, hundreds of young men like him were all doing the same thing. Teaching themselves to fly, so that when their country called, they would be able to answer.

That call came on December 7, 1941. After the attack on Pearl Harbor, over 134,000 Americans rushed to enlist.1 Harold was no exception. As soon as he graduated from high school, he applied to join a new, recently activated unit of airmen.

But there was a major obstacle to overcome – Harold and many of these other pilots were Black.

Due to the racial attitudes of the day, many in the military did not believe Black people could make good pilots. During World War I, all African-American pilots were rejected from serving. In 1925, a War Department report suggested Black soldiers were “cowardly, incapable of higher learning, and lazy.”2 Even by 1940, the U.S. Census counted only 124 Black pilots in the United States.

Despite this prejudice, many, like Harold, had participated in civilian pilot training programs, and were eager to show what they could do in service to their country. So, after sustained public pressure, the War Department finally created an all-Black unit called the 99th Pursuit Squadron. (The 100th, the 301st, and the 302nd squadrons would come online later in the war.) The pilots began training at facilities in Tuskegee, Alabama, where they were joined by thousands of other African-Americans, all training to be navigators, bombardiers, flight surgeons, mechanics, and engineers.

These were the legendary Tuskegee Airmen.

From the start, nothing was easy for these trailblazers. They were spat on and laughed at. Abused and humiliated. Passed over for promotion. Denied entry into nearby clubs, movie theaters, and restaurants. Forbidden to train with white pilots. Local laundries sometimes refused to wash their clothes. One Black lieutenant was court-martialed after trying to enter the base Officer’s Club. Most of the airmen experienced segregation and poor treatment just getting to Tuskegee. Perhaps worst of all was the constant expectation they would fail. As Harold later described it: “It was felt that this big experiment was going to fail and fall flat on its face. ‘They’ll never make it as pilots.’ That was really one of our biggest motivations – that we cannot fail. We just can’t.”2

Things weren’t any better in Europe. Harold and the other pilots would have to fly from their base to a “white base” just to receive their orders. And they would see enemy propaganda posters depicting them as gorillas or apes…as people somehow less than human.

Despite these conditions, the Tuskegee Airmen became one of the most elite groups in the entire American military. After their combat missions began in 1943, the records followed. Number of enemy aircraft destroyed. Number of sorties flown. Number of missions completed. Their ability to protect bomber formations from harm became the stuff of legend. (There is a story that the Tuskegee Airmen never lost a bomber. That’s not quite true – records indicate at least 25 bombers were shot down – but this was a much higher success rate than other units, which lost an average of 46 bombers.3)

And, of course, they gave their lives in service to our country. At least 66 of the Tuskegee Airmen were killed in action, while another 32 were captured as POWs.3 That includes Harold, who was shot down in Austria and nearly murdered by an angry mob.

When the Tuskegee Airmen returned home after the war, they came home to a country that was still in the grip of segregation. Despite being ace pilots, many who left the military were prevented from flying commercially and had to turn to other jobs. But without realizing it, they had changed the military. They had changed the country.

Because of their example, the Tuskegee Airmen helped prove to the nation that it didn’t matter what color your skin was. When it comes to serving your country, all that matters is what’s in your head and in your heart. Courage, commitment, self-sacrifice…these are qualities that transcend any sort of category. They were qualities the Tuskegee Airmen showed every day. Qualities that helped lead to the desegregation of the military in 1948…and, eventually, the end of segregation everywhere.

When World War II ended, there were nearly a thousand pilots who trained at Tuskegee. Today, in 2023, there are less than 10.4 Harold himself passed away in January at the age of 98. But, as we prepare to celebrate another Veterans Day, I think it’s important to remember the Airmen and their legacy. Like all veterans, their choice to serve was not an easy one. It was filled with danger and difficulty. But because of their decision – because of their courage, their commitment – they not only helped win the war…they helped shape our country. And that is what makes Veterans Day so important. It’s a chance to truly give thanks to the men and women who not only defended our nation but made it what it is today.

As Harold once said: “I always hoped that the country would change…and, of course, the country has changed. Are there still problems? Sure, there are still problems out there. But even with the problems, we aren’t anyplace close to where we were 70-some years ago. It’s a whole new world.”2

A whole new world. A world that the Tuskegee Airmen – and all our veterans – helped make for us.

On behalf of everyone at Minich MacGregor Wealth Management, we wish you a happy Veterans Day…and a heartfelt “Thank you” to all who serve.

1 “14 Interesting Pearl Harbor Facts,” Pearl Harbor Tours, https://click.mmwealth.com/e/877382/blog-facts-about-pearl-harbor-/bq6zqg/3744071557/h/PCwSZhbr4OGDqG34eO0jepsakDhStmAQCAjnyBLlL9Y

2 “Harold Brown, one of the last Tuskegee Airmen, recalls battling for victory,” The Plain Dealer, https://click.mmwealth.com/e/877382/-for-victory-and-equality-html/bq6zqk/3744071557/h/PCwSZhbr4OGDqG34eO0jepsakDhStmAQCAjnyBLlL9Y

3 “Tuskegee Airmen,” History.com, https://click.mmwealth.com/e/877382/s-world-war-ii-tuskegee-airmen/bq6zqn/3744071557/h/PCwSZhbr4OGDqG34eO0jepsakDhStmAQCAjnyBLlL9Y

4 “Harold Brown, Tuskegee Airman Who Faced a Lynch Mob, Dies at 98,” The NY Times, https://click.mmwealth.com/e/877382/ed-a-lynch-mob-dies-at-98-html/bq6zqr/3744071557/h/PCwSZhbr4OGDqG34eO0jepsakDhStmAQCAjnyBLlL9Y