Today is Halloween and our thoughts turn to carving jack-o’-lanterns, trick-or-treating, haunted houses, festive costumes, and scary movies. Halloween is the only holiday that has the ability to both delight and fright. Costumed children gleefully celebrate their plunder from a neighborhood trick-or-treat. Others brave the ghoulish horrors of a haunted house or ghastly terrors of Halloween movies.

In a way, markets have the same ability: to both delight and fright. After the better part of the year in market turmoil, it is probably starting to feel like we’ve been locked in a haunted house too long!

A client recently shared with us that he appreciates the “pep talks” our emails provide, but he would like to see something more technical from time-to-time. So, we’re going to do just that.

To make this a little fun, however, see if you can identify who said the headings of each section of this post! Just in case, we’ve included the answers at the end.

LIONS AND TIGERS AND BEARS, OH MY!

In the present environment, we can’t talk about inflation without talking about interest rates. The US inflation rate has declined somewhat, reaching 8.2% in September. This is the lowest level in the past seven months, falling from a high of 9.1% in June of this year.1

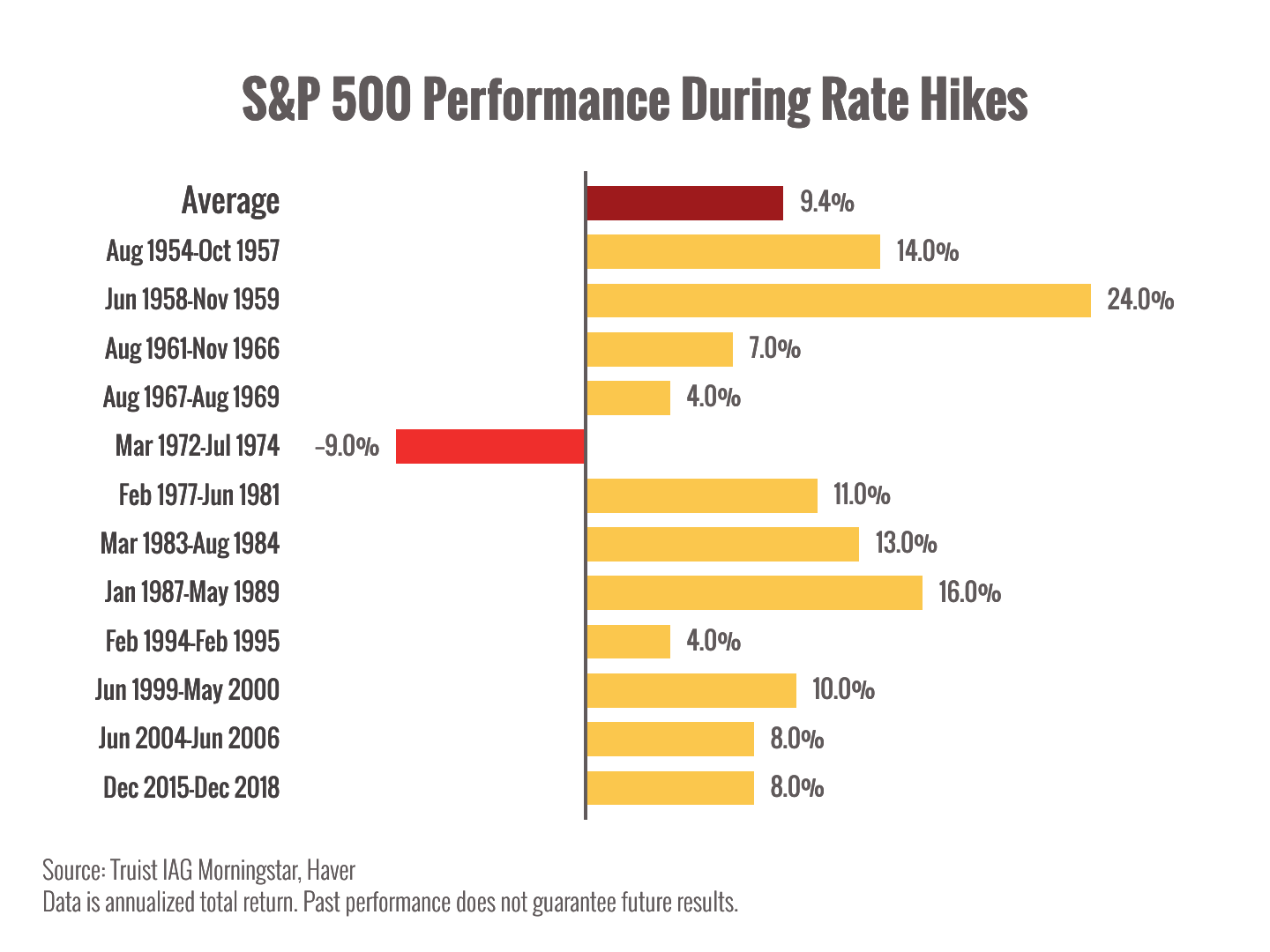

This has occurred amidst a series of interest rate hikes. The Federal Reserve has raised rates five times so far this year, with a likelihood of at least one more in 2022.2 The cause-and-effect between declining inflation and rising interest rates is not coincidental; it’s consequential. Simply put, the Fed is using interest rate increases to slow down consumer demand. Companies and consumers tend to borrow and spend less when the cost of doing so goes up. As borrowing and spending decline, inflation declines.

This isn’t the first time the Federal Reserve used this strategy. In the early 1980s, the Fed used aggressive rate hikes to tame double-digit inflation and restore balance to the US economy and markets.3

So, is the strategy working today? It appears to be. Inflation is declining, slowly, but declining.

What is a “good” inflation rate? The Federal Reserve would like inflation to recede to near 2%.2

How long will that take? Like a hot car engine, inflation takes time to cool. The important thing to remember is that steady progress toward lower inflation may be as important to Wall Street as reaching the goal. Why? Because steady progress is better than uncertainty, and we know Wall Street does not like uncertainty.

A final thought on rising interest rates. While rising rates are currently pressuring bond values, increased rates are finally making bonds, treasuries, CDs, and other fixed income attractive again. This is long overdue in our opinion. Investment-grade fixed income is usually a helpful risk-management element of a portfolio. It hasn’t been performing to its potential for some time because of the historically low interest rate environment. Rising rates should ultimately be positive for fixed income.

DOUBLE, DOUBLE TOIL AND TROUBLE

When high inflation and rising interest rates come together, higher unemployment usually follows. So far, however, this is not the case in the US economy. The September unemployment rate was 3.5%, falling from a high of 4.0% in January.4 Recently revised projections by Goldman Sachs see a slight uptick to 3.7% by year-end and possibly 4.1% by the end of 2023.5

The number of job openings in the US shrank notably from 11.2 million in July to 10.1 million in August. Layoffs remain historically low, and overall hiring is largely unchanged. In essence, employers may be getting more selective about hiring, but they aren’t slashing jobs or refusing to add jobs.6

Add to these facts that business borrowing by US companies remains relatively healthy. In other words, companies have a positive enough outlook to acquire the goods and services needed to respond to customer demand.7 If companies felt financial trouble was on the horizon, they would be cutting budgets and laying off employees. That doesn’t seem to be happening, at least not yet.

I GOT A ROCK

That probably summarizes how most of us feel about investments right now.

However, when putting together all the things we just reviewed, it may mean that the Federal Reserve’s plan to slow down the economy without triggering a recession could be working. That said, this chapter in the US economy is not yet at an end. There are some hints suggesting that we’re moving in the right direction, but those hints need to turn into steady progress. Until then, volatility will likely remain.

So, what does all of this mean for your investments? We haven’t gotten out of the haunted house yet, but there are glimpses of light suggesting we might be moving closer to the exit.

JUST BECAUSE I CANNOT SEE IT, DOESN’T MEAN I CAN’T BELIEVE IT

We know what you’re thinking. “Seriously, are you really going to tell us yet again to stay the course?!?”

We understand. Fatigue and weariness are setting in while we wait for some signs of better markets ahead. Truth is, we’ve been rather spoiled in the 14 years since the Great Recession of 2008. Only two times since then did we experience a bear market. Markets fell 27.62% between January and March 2009, but recovered in just 62 days. The second bear market occurred during just 4 short weeks between February and March 2020. Markets declined 33.92%, but speedily recovered in a mere 33 days.8 Markets rebounded so quickly, some probably never noticed these events.

You’re noticing now, however, and that’s simply because markets are taking longer to recover.

So, are markets going to recover? We believe, yes. Over the last 70 years of market history, there have been nine bear markets (defined as a 20% decline or more). The average decline was 33%. The average length was about 14 months. Conversely, the average bull market return during that same period was 268%. The average expansion lasted 70 months.9 Let’s think about those averages in the form of a question: Is one year of market pain worth nearly six years of market gain?

This is why trying to time the market is so very tricky. Between 1930 to 2020, the S&P 500 cumulatively returned 17,715%. Yes, you read that figure correctly. Now, let’s exclude the 10 best days per decade. Some quick math tells us that’s just 90 days out of about 21,600 trading days. Remove those 90 best days, and the cumulative return is 28%.10 Yes, you read that figure correctly, too!

Now, you might be thinking, “Why can’t you figure out something to at least save us from the worst days?” We agree that would be great, except no one knows a “worst day” IS happening until it HAS actually happened. The same applies to the market’s best days. The “timing” trap gets more complicated when you know that the market’s best days most often follow closely after the market’s worst days. In fact, over the past 30 years, ALL of the ten (10) best trading days in terms of percentage increase occurred during recessions.11

THINGS ARE NEVER QUITE AS SCARY WHEN YOU’VE GOT A BEST FRIEND

We may not be your best friends, but we are your trusted financial advisors! And part of our job is to take the scary out of the markets. Your investment strategies are tuned to your financial goals and objectives. They are built with the expectation that we will experience good and bad markets. Staying true to your strategy is what helps us and you meet your goals and objectives.

On Halloween, we here at Minich MacGregor Wealth Management encourage you to leave the fright, the dark, the scary, and the terrifying for the Halloween movies and haunted houses of the season. The delight of good markets comes with the occasional fright of bad markets. Savvy investors don’t let emotions of those occasions steer them away from time-tested strategies designed to achieve their goals and objectives.

As always, we are here for you. If you have any questions or concerns, please call our office. Have a happy Halloween!

1 “United States Inflation Rate,” Trading Economics, https://tradingeconomics.com/united-states/inflation-cpi

2 “The Fed forecasts hiking rates as high as 4.6% before ending inflation fight,” CNBC, September 21, 2026. https://www.cnbc.com/2022/09/21/the-fed-forecasts-hiking-rates-as-high-as-4point6percent-before-ending-inflation-fight.html

3 “Paul Volcker,” Wikipedia, https://en.wikipedia.org/wiki/Paul_Volcker

4 “United States Unemployment Rate,” Trading Economics, https://tradingeconomics.com/united-states/unemployment-rate

5 “Goldman Sachs cuts 2023 outlook for US growth,” Fox Business, https://www.foxbusiness.com/economy/goldman-sachs-cuts-2023-outlook-us-growth

6 “United States Job Openings,” Trading Economics, https://tradingeconomics.com/united-states/job-offers

7 “U.S. Business Borrowing for Equipment Rises 6% in September,” US News, https://money.usnews.com/investing/news/articles/2021-10-25/us-business-borrowing-for-equipment-rises-6-in-september-elfa

8 “The Complete History of Bear Markets,” Seeking Alpha, https://seekingalpha.com/article/4483348-bear-market-history

9 “Bear markets look less fierce with a long-term perspective,” Capital Group, https://www.capitalgroup.com/individual/insights/articles/bull-bear-history.html

10 “This chart shows why investors should never try to time the stock market,” CNBC, https://www.cnbc.com/2021/03/24/this-chart-shows-why-investors-should-never-try-to-time-the-stock-market.html

11 “The perils of trying to time volatile markets,” Wells Fargo, https://www.wellsfargo.com/investment-institute/sr-perils-time-volatile-markets/

QUOTES QUIZ ANSWERS:

“Lions and tigers and bears, oh my!” – Dorothy, The Wizard of Oz

“Double, double toil and trouble” – Three Witches, Macbeth, William Shakespeare

“I got a rock” – Charlie Brown, It’s the Great Pumpkin, Charlie Brown, George Shultz

“Just because I can’t see it, doesn’t mean I can’t believe it” – Jack Skellington, Nightmare Before Christmas

“Things are never quite as scary when you’ve got a best friend” – Calvin and Hobbes, Bill Watterson